A government proposal that would raise the minimum energy performance certificate (EPC) rating of buy-to-let properties is already influencing purchasing decisions. If you’re a landlord, thinking about how the potential changes could affect you now could pay off in the long term.

An EPC shows how energy-efficient a property is by giving it a rating from A (most efficient) to G (least efficient).

Under current rules, any property that is rented must have an EPC and a minimum rating of E, unless there is a valid exemption in place. Exempt properties may include listed or officially protected buildings that would be unacceptably altered when installing energy efficiency measures.

However, as part of the government’s steps to reduce emissions, the minimum rating for buy-to-let properties could rise.

The minimum EPC rating for rental properties could rise to C by 2028

While the government hasn’t confirmed new rules yet, it has set out proposals. These would see all new lets requiring a minimum EPC rating of C by 2025, and by 2028 for existing lets.

Not having an EPC rating that meets the minimum standards could result in a fine for landlords. So, it’s important to understand the proposed changes and how they could affect your property portfolio.

Purchasing data suggests it’s something that many landlords buying a new property are already considering.

According to figures from estate agents Hamptons, half of all homes brought by investors so far this year have an EPC rating of C or above.

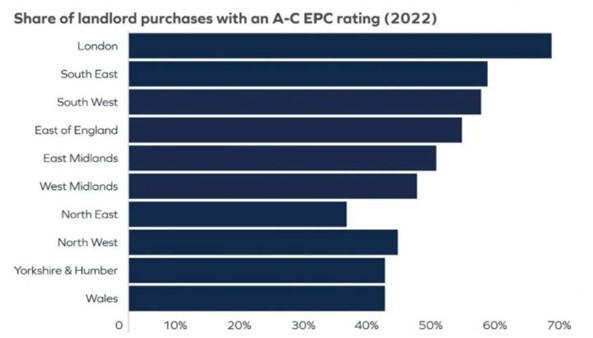

While the figures suggest that landlords are keen to get ahead of eco rules, there are significant differences across regions in England and Wales. Two-thirds of new buy-to-let purchases in London already have an EPC rating of C or above. In contrast, just 34% of new purchases in the North East have a minimum rating of C.

Source: Hamptons

The research suggests that the trend has been driven by landlords purchasing homes, particularly flats, that have been built in the last decade. New-build properties typically have an EPC rating of B or C.

In addition, some are choosing to purchase older properties that have already been improved.

If you’re looking to purchase a new property, considering the EPC rating alongside rental yield and other factors can mean you’re better off in the long term.

But what should you do if you already have a property portfolio that doesn’t meet the proposed EPC rating?

52% of property investors would consider selling if the minimum EPC rating rises

If you have an existing rental property that doesn’t meet the proposed EPC changes, it’s worth considering what your options are.

According to a report in the Financial Reporter, 52% of landlords with properties rated D or below would consider selling the property if EPC rules are changed. This is because they don’t think they’ll be able to complete or finance the work that would be required to get their property to the new standard.

If you want to keep your rental property, you may be able to improve the existing EPC rating. From loft insulation to double glazing, there are often many things you can do to improve the energy efficiency of a property.

However, 33% of landlords don’t know what steps they’d need to take to improve their property.

An EPC assessment will include a list of potential savings that can be made if energy-efficient steps are taken. It can help you see which projects to focus on to get the most out of your money.

When asked, the most common steps landlords said they need to take to improve their property’s EPC rating were:

- Fit traditional insulation (37%)

- Upgrade the boiler (25%)

- Upgrade existing utilities (24%).

Once you understand which steps will improve the EPC rating of your property, ask local tradesmen for quotes for the work. Make sure these are transparent and will lead to the improvements you need so you can assess if undertaking the work makes financial sense for you.

An eco-friendly property could lower your mortgage costs too

A property with a better EPC rating can ensure you meet legal requirements and avoid potential fines. Did you know it could also lower your mortgage costs?

A growing number of banks and building societies will offer landlords a lower interest rate if their home is more energy-efficient.

Green mortgages may offer lower interest rates, as they are viewed as more valuable to prospective buyers and renters who would benefit from lower energy bills. You will usually need an EPC rating of A or B to qualify for a green mortgage.

If you’re looking for an eco-property to let out or are carrying out work to improve a property, reviewing green mortgages could help you get more out of your investment. Please contact us to discuss your mortgage needs.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Some buy-to-let mortgages are not regulated by the Financial Conduct Authority.